bloom energy stock forecast 2022

The consensus outlook for earnings per share EPS in 2022 has deteriorated. Innovative Fuel Cell Technology in High Demand.

Bloom Energy s earnings in 2022 is -164445000On average 5 Wall Street analysts forecast BEs earnings for 2022 to be -120439810 with the lowest BE earnings forecast at -131066852 and the highest BE earnings forecast at -113355116.

. 54 rows Bloom Energy Corporation Stock Forecast NYSE. For Bloom Energy stock forecast for 2022 9 predictions are offered for each month of 2022 with average Bloom Energy stock forecast of 2422 a high forecast of 2689 and a low forecast of 2144. The entity has historical hype elasticity of -014 and average elasticity to hype of competition of 004.

Bloom Energy showed a net loss of 33323 million. Bloom Energy Corp technical analysis gives you the methodology to make use of historical prices and. Annual revenue last year 9722M.

Annual profit last year-1644M. On average they anticipate Bloom Energys share price to reach 2892 in the next year. The average Bloom Energy stock forecast 2022 represents a 1477 increase from the last price of 211000003814697.

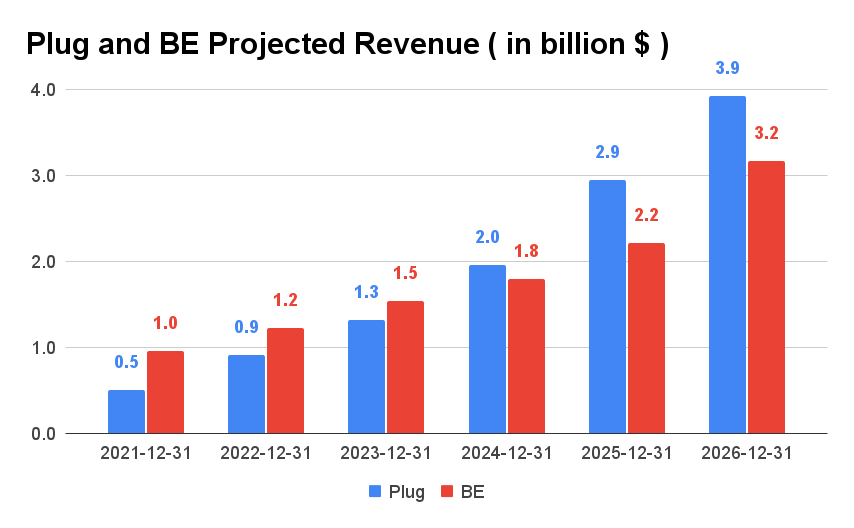

Bloom Energy Corporations market cap currently stands at around 373 billion with investors looking forward to this quarters earnings report slated for Apr 11 2022 Apr 15 2022. With a 5-year investment the revenue is expected to be around 14198. Forcasts revenue earnings analysts expectations ratios for BLOOM ENERGY CORPORATION Stock 0A4L US0937121079.

About the Bloom Energy Corp. Stock forecast As of 2022 March 28 Monday current price of BE stock is 24180 and our data indicates that the asset price has been in an uptrend for the past 1 year or since its inception. Bloom Energy foresees the number of module deliveries or acceptances continuing to increase for the year as well.

Their forecasts range from 2000 to 4300. Blooms solution has always been that fuel cells need to deliver competitive cost and performance to get in the game. The company gave a forecast for 2022 financial performance with one-year revenue estimates between 11 billion and 15 billion.

With all that in mind lets get down to the numbers. Your current 100 investment may be up to 29384 in 2027. With a 5-year investment the revenue is expected to be around 19384.

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Ad Were all about helping you get more from your money. Given Bloom Energys higher possible upside analysts plainly believe Bloom Energy is more favorable than Sasol.

14 Wall Street analysts have issued 12 month target prices for Bloom Energys stock. Bloom Energy Corporation NYSEBE shares rose in value on Wednesday 033022 with the stock price down by -365 to the previous days close as strong demand from buyers drove the stock to 2454. As of March 26 2022 Bloom Energy Corp is listed for 2418.

Based on our forecasts a long-term increase is expected the 1ZB stock price prognosis for 2027-02-15 is 48043 EUR. Bloom Energy has a consensus price target of 2892 indicating a potential upside of 1962. Bloom is forecasted to decline in value after the next headline with price expected to drop to 2404.

If you are looking for stocks with good return Bloom Energy Corp - Class A can be a profitable investment option. BLOOM ENERGY CORPORATION. Bloom Energy Corp - Class A quote is equal to 21200 USD at 2022-03-16.

As of the 17th of March 2022 Bloom Energy shows the Risk Adjusted Performance of 00148 downside deviation of 411 and Mean Deviation of 372. Bloom Energy Corporation quote is equal to 16350 EUR at 2022-02-18. Actively observing the price movement in the last trading the stock closed the session at 2547 falling within a range of 243726 and 2558.

EPS forecast this quarter-010. Losses expected to increase from US042 per share to US058. This suggests a possible upside of 208 from the stocks current price.

The average volatility ofmedia hypeimpact on the company stock price is over 100. Electrical industry in the US expected to see average net income growth of 20 next year. Analyst estimates including BE earnings per share estimates and analyst recommendations.

Bloom Energys end goal is to achieve an 85 per watt cost of energy by 2022. Lets get started today. 1 day and price target of 2444 USD.

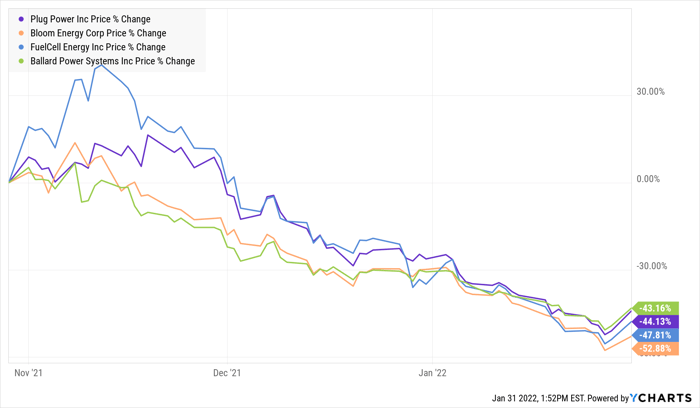

Bloom Energy stock has kicked off 2022 on a somber note with shares of the fuel cell specialist dropping 114 through the first week of January as of 1230 pm. Analysts project the companys earnings per share EPS to be -004 which has seen fiscal year 2021 EPS growth forecast to increase to -052 and about. 2022 revenue forecast decreased from US120b to US114b.

Based on our forecasts a long-term increase is expected the BE stock price prognosis for 2027-03-12 is 51300 USD. Bloom Energy Corp. Forecast for Fri 20 May 2022 price 2282 BLOOM ENERGY CLASS A CORP stock price forecast for further price development up to 106 time horizon.

Bloom Energy Corp Share Price Usd0 0001 A

Dow Jumps More Than 200 Points To Record Close To Start 2022 Tesla Boosts Nasdaq By 1

Why Plug Power Bloom Energy And Other Fuel Cell Stocks Jumped Today Nasdaq

Fed S Powell Looks To Balance Inflation Ukraine Risks Eco Week Bnn Bloomberg

Green Hydrogen Is Poised For Another Strong Year In 2022

3 Stocks With Nft Exposure That Could Make You Rich In 2022 Nasdaq

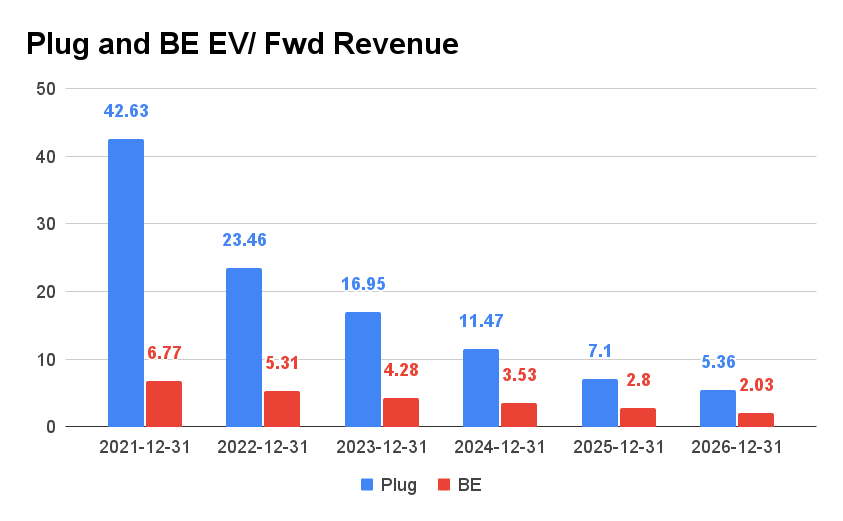

Plug Power Vs Bloom Energy Stock Which Is The Better Buy Seeking Alpha

2022 Is Not The Time To Give Up On Marijuana Stocks The Motley Fool

Kinder Morgan Stock Set For A Revaluation Nyse Kmi Seeking Alpha

The 3rd Hainan Island International Film Festival Opened In Sanya Hainan China International Film Festival Sanya Hainan

North America Eyewear Market Volume By Product 2014 2024 Million Units This Article Is Talking About The Gr Alcohol Marketing Marketing Chemical Industry

Bloom Energy Corp Class A Price Be Forecast With Price Charts

Pantone Very Peri El Color Del Ano 2022 Te Va A Gustar Colores Pantone Pantone Color Del Ano

At T Stock Forecast Discovery Deal Big Gains Coming In 22 Nyse T Seeking Alpha

At T Stock Forecast Discovery Deal Big Gains Coming In 22 Nyse T Seeking Alpha

Plug Power Vs Bloom Energy Stock Which Is The Better Buy Seeking Alpha